Medical travel insurance | Seniors over 60 | travel cover | Insurance comparison

Did you know? One in two people aged over 60 will have a fall at least once a year, according to the NHS. If you have a fall while travelling, Travel Insurance will cover your costs. With air ambulance prices reaching between £10,000 to upwards of £50,000, Explore options for travel insurance that will protect you from costly medical expenses.

What Is Medical Travel Insurance?

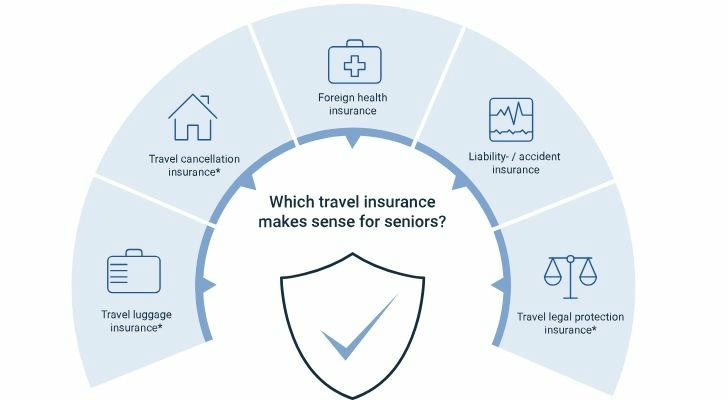

Medical travel insurance is a specialised policy that covers:

- Emergency medical treatment abroad

- Hospitalisation and repatriation

- Supplementary benefits like trip cancellation, lost baggage, or evacuation

Its importance rises with age, especially for those over 60, as it safeguards both health and finances in case of unexpected illness overseas.

Travel Insurance Price Comparison

Here’s a comparison table based on typical quotes for a twoweek trip to Europe in June2025:

| Insurer | Age60–64 | Age65–69 | Age70–74 | Age75+ | Advantages |

|---|---|---|---|---|---|

| Staysure | £45 | £60 | £85 | £120 | No upper age limit; covers most preexisting conditions; Comprehensive medical coverage |

| AllClear | £50 | £70 | £100 | £140 | Covers 1,300+ conditions; 24/7 helpline; no upper age limit |

| William Russell | £55 | £75 | £110 | £150 | Fast online quotes; flexible plans for expats and longer stays |

| Aviva | £40 | £55 | £80 | £115 | Competitive pricing; GHICcompatible; cruise options |

Summary of Advantages:

- Staysure: No upper age limit, most preexisting conditions covered, Comprehensive medical cover.

- AllClear: Specialist medical cover, extensive condition list, strong support.

- William Russell: Tailored for longer stays, online efficiency.

- Aviva: Budgetfriendly option for GHIC holders and casual travellers.

As can be seen from the table above, if you do not have any physical illness, the reasonable price of travel insurance for an elderly person for a two-week trip is between £40 ~ £150.

How to Get the Best Quote & Application Process

- Shop around early — use sites like GoCompare, MoneySuperMarket or MoneyHelper’s directory.

- Be truthful about your health — declaring preexisting conditions avoids voiding claims.

- Choose trip type: singletrip is best for occasional travel; annual multitrip suits frequent travellers.

- Adjust excess and limits: higher excess reduces premium but increases your cost if you claim.

- Call specialist providers: AllClear, Staysure, William Russell, Saga have no age limit and handle medical conditions well.

- Complete medical screening: forms or phone calls ensure full disclosure.

- Apply online or by phone: most quotes finalise within 24 hours.

Real-Life Case Study

Case: Janet, 72, retired teacher

- Trip: 14 days in Portugal

- Conditions: type2 diabetes; mild asthma

- Process:

- Compared quotes via MoneyHelper directory and GoCompare

- Contacted AllClear by phone to verify coverage

- Selected AllClear singletrip with £100 excess

| Insurer | Quote | Coverage highlights |

|---|---|---|

| AllClear | £100 | Full medicals + repatriation |

| Aviva | £115 | Excluded asthma |

| Staysure | £120 | Comprehensive, but costlier |

- Outcome:

- Janet fell and fractured her arm in Lisbon

- Covered costs: ambulance (£350), hospital care (£5,200), repatriation flight (£1,600)

- No medical bills out of pocket—just the £100 excess

- Travel delay led to £250 from AllClear’s coverage for trip interruption

Conclusion: Full transparency and specialist quoting saved her over £7,000, with minimal personal cost.

FAQs

Q: Do you still need travel insurance if you have a GHIC card?

A: Yes, you still need to get travel insurance even if you have a GHIC card. Although the GHIC will cover your medical expenses in the event of an emergency, it will not cover things like transport to or from the hospital. The GHIC also doesn’t cover any other holiday mishaps, such as lost luggage, delays or cancellations. The UK Government recommends that you always get travel insurance with medical cover, no matter what country you are visiting.

Q: Will declared preexisting conditions increase premiums?

A: Yes—sometimes they’re excluded, but declaring avoids claim refusals.

Q: Is there an upper age limit?

A: Specialist providers like AllClear, Saga, Staysure, William Russell have no upper limit.

Q: Single trip or annual cover?

A: Single is costeffective for one or two trips; annual suits three or more.

Q: How much does Travel Insurance cost for UK seniors?

A: There is no standard cost for Travel Insurance For Seniors, as this is dependent on several different factors. For example, it will be affected by your age, whether you have any pre-existing conditions, where you’re going, and whether or not you need any additional extras, such as cruise cover. All of this means a different cost for each policy.

Q: Does cruise or winter sports need extra cover?

A: Usually yes—these need add-ons for safety and evacuation.

Final Tips

- Start your search early — don’t leave insurance until just before travel.

- Disclose all medical conditions — honesty protects your policy.

- Match the policy to your trip — cruises, winter, GHIC status affect what's needed.

- Compare and don’t skip specialist insurers — they often offer the best value for senior travellers.